Comparing Car Leasing vs. Buying: Which Option Is Right for You? This age-old question faces every prospective car owner. The decision hinges on a complex interplay of financial considerations, lifestyle preferences, and long-term goals. Understanding the nuances of leasing versus buying – from upfront costs and monthly payments to maintenance responsibilities and resale value – is crucial for making an informed choice that aligns perfectly with your individual needs and circumstances. This guide delves into the intricacies of each option, empowering you to navigate the car-buying landscape with confidence.

We’ll explore the initial investment required for both options, comparing down payments, security deposits, and other associated fees. We will then analyze monthly payments, factoring in loan terms, interest rates, and potential additional lease charges. The impact of depreciation on overall cost, ownership experiences, and the responsibilities of maintenance and repairs will also be meticulously examined. Finally, we will consider the long-term financial implications, lifestyle compatibility, and the flexibility each option offers, culminating in a clear path towards making the best decision for you.

Initial Costs Comparison

Choosing between leasing and buying a car involves a careful consideration of upfront costs. While the monthly payments might seem lower for leasing, the initial outlay can be significantly different. Understanding these differences is crucial for making an informed decision. This section will detail the initial costs associated with each option, highlighting the impact of interest rates and sales tax.

Upfront Costs: Leasing vs. Buying

The initial investment for leasing and buying a vehicle varies considerably. Leasing typically requires a lower down payment and often avoids the need for a large security deposit, but it does include other fees. Buying, conversely, usually demands a larger down payment, potentially including a security deposit, but avoids many of the fees associated with leasing. The following table illustrates a typical comparison:

| Cost Category | Typical Lease | Typical Purchase | Notes |

|---|---|---|---|

| Down Payment | $1,000 – $3,000 | $5,000 – $10,000 or more | Varies greatly depending on the vehicle’s price and lease terms. A purchase down payment is usually a much larger percentage of the vehicle’s price. |

| Security Deposit | Often waived or minimal | Usually 1-2 months’ rent or equivalent (if financing) | Lease security deposits are generally smaller or non-existent. For purchases, a security deposit might be required if financing. |

| Acquisition Fee | $500 – $1,000 | $0 | A one-time fee charged by the leasing company. Not applicable to purchases. |

| First Month’s Payment | Included in upfront costs | Not typically included upfront (unless rolled into financing) | The first month’s lease payment is usually due at signing. For purchases, the first payment is typically due after the vehicle is delivered. |

| Sales Tax | Usually paid on the capitalized cost | Usually paid on the full purchase price | See detailed explanation below. |

| Other Fees | Possible additional fees for early termination, excess mileage, etc. | Possible additional fees for title and registration | Fees vary greatly depending on the lease and purchase agreements. |

Impact of Interest Rates

Interest rates significantly influence the total cost of both leasing and buying a car. For purchases financed with a loan, a higher interest rate increases the total amount paid over the loan term. For leases, the interest rate is factored into the monthly payment and the capitalized cost (the price the leasing company uses to calculate payments). A higher interest rate will result in higher monthly payments and a higher overall cost for the lease. For example, a 5% interest rate on a $25,000 loan will result in a higher total cost compared to a 3% interest rate. Similarly, a higher interest rate on a lease will lead to increased monthly payments and a higher overall cost.

Sales Tax Implications

Sales tax is applied differently to leases and purchases. When buying, sales tax is typically calculated on the full purchase price of the vehicle. When leasing, sales tax is usually calculated on the capitalized cost of the lease, which is generally lower than the vehicle’s sticker price. This means the total sales tax paid over the lease term will likely be less than the sales tax paid when buying. However, it’s crucial to understand the exact terms of the lease agreement regarding sales tax calculation.

Monthly Payments

Understanding the monthly cost is crucial when deciding between leasing and buying a car. Both options involve regular payments, but the structure and implications differ significantly. This section compares typical monthly payments for leasing and financing, highlighting the factors that influence these costs.

Generally, lease payments are lower than loan payments for the same vehicle. This is because you’re only paying for the car’s depreciation during the lease term, not its full purchase price. However, this lower monthly payment comes with other considerations, as detailed below.

Lease versus Loan Payment Comparison

The following table illustrates a typical comparison of monthly payments for a hypothetical vehicle, assuming similar creditworthiness. Remember that actual payments will vary depending on the specific vehicle, lender, and terms of the agreement.

| Payment Type | Loan Term (Months) | Interest Rate (APR) | Estimated Monthly Payment |

|---|---|---|---|

| Lease | 36 | N/A (included in monthly payment) | $400 |

| Loan | 60 | 5% | $600 |

| Loan | 72 | 5% | $500 |

| Loan | 60 | 7% | $650 |

Factors Influencing Monthly Payment Amounts

Several factors significantly influence the monthly payment amount for both leases and loans. Understanding these factors allows for informed decision-making.

For loans, the loan term and interest rate are paramount. A longer loan term (e.g., 72 months versus 60 months) results in lower monthly payments but increases the total interest paid over the life of the loan. Similarly, a higher interest rate increases the monthly payment. For example, a 7% interest rate on a 60-month loan will result in higher monthly payments than a 5% interest rate on the same loan.

Lease payments are influenced by the vehicle’s capitalized cost (the price of the vehicle), the residual value (the projected value of the vehicle at the end of the lease), the money factor (the interest rate equivalent for leases), and the lease term. A lower capitalized cost, higher residual value, and lower money factor will all lead to lower monthly payments. The lease term also impacts the monthly payment; a shorter lease term generally results in higher monthly payments.

Potential for Additional Lease Fees

Lease agreements often include additional fees that can increase the overall cost. It is essential to understand these potential costs before signing a lease.

These fees can include, but are not limited to, acquisition fees, disposition fees (charged at the end of the lease), early termination fees, excess mileage charges (if you exceed the agreed-upon mileage limit), and wear-and-tear charges (if the vehicle is returned in poor condition). These fees can add hundreds or even thousands of dollars to the total cost of leasing, significantly impacting the overall financial picture.

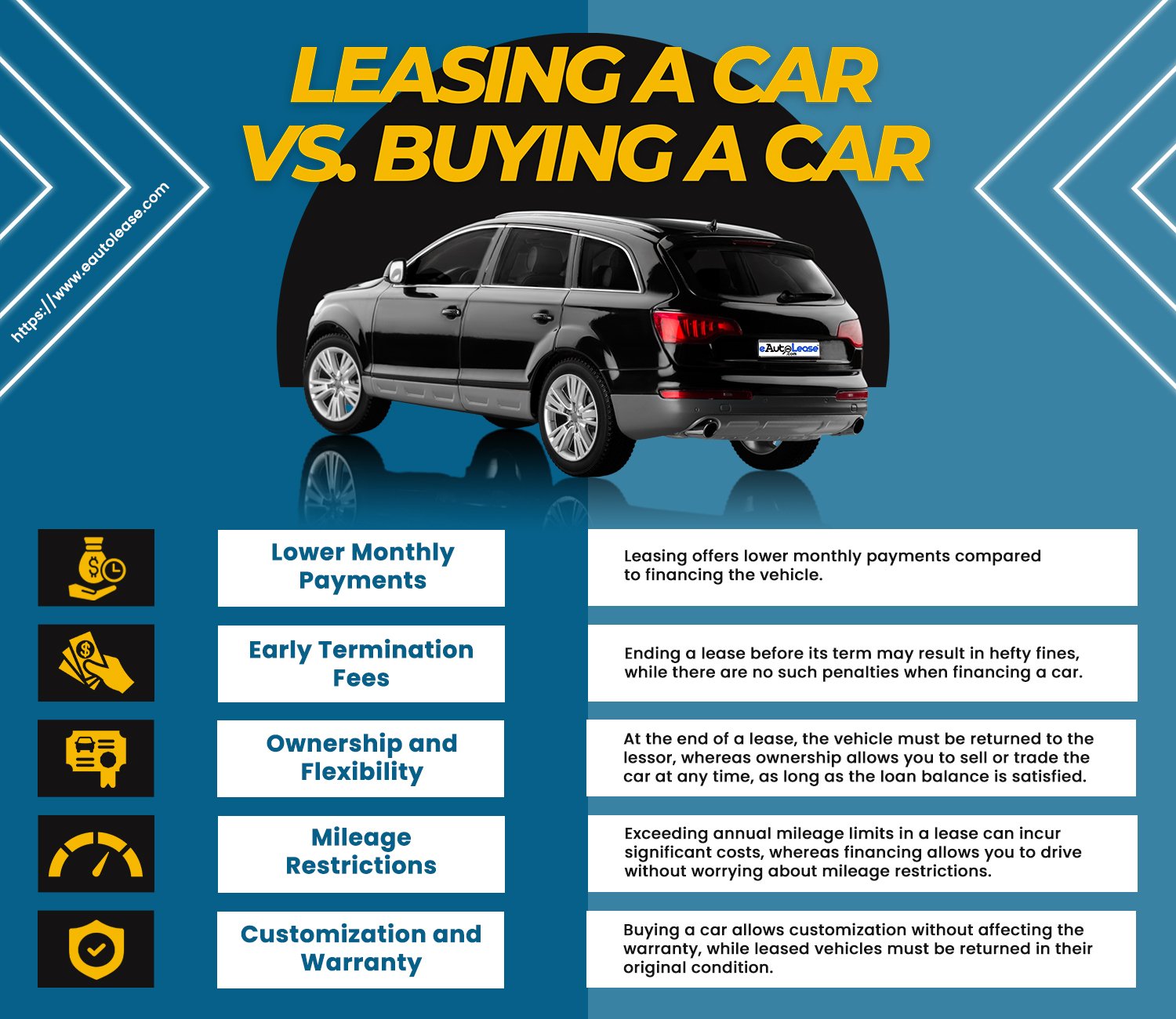

Vehicle Ownership and Depreciation

Leasing and buying a car offer distinctly different ownership experiences, significantly impacted by how each handles vehicle depreciation. Understanding these differences is crucial for making an informed decision that aligns with your financial goals and lifestyle.

Depreciation, the decrease in a car’s value over time, is a major factor influencing the overall cost of both leasing and buying. While both options are affected, the impact differs substantially, leading to varying financial outcomes. In a lease, the depreciation burden largely falls on the leasing company. Conversely, when you buy a car, you bear the full brunt of depreciation.

Depreciation’s Impact on Leasing and Buying

Leasing transfers much of the depreciation risk to the leasing company. You essentially pay for the car’s use during the lease term, not its entire depreciated value. At the end of the lease, you return the vehicle, avoiding the significant depreciation that typically occurs in the later years of ownership. Buying, however, means you absorb the full depreciation. The car’s value diminishes steadily from the moment you drive it off the lot. This loss of value is a significant, often overlooked, cost of car ownership.

A Hypothetical Depreciation Example

Let’s imagine you purchase a new car for $30,000. After three years, its value might depreciate to $18,000. This represents a $12,000 loss due to depreciation. If you had leased the same car for three years, your monthly payments would reflect only a portion of that depreciation, with the leasing company absorbing the majority. The actual depreciation amount varies widely based on factors like make, model, mileage, and overall condition. However, the principle remains consistent: leasing mitigates your exposure to depreciation, while buying exposes you to the full impact.

Owning a Vehicle Outright: Benefits and Drawbacks

Once you’ve paid off your car loan, you own the vehicle outright. This offers several benefits, including freedom from monthly payments and the ability to sell the car at any time. You also build equity as the car’s value (even if depreciated) remains yours. However, the significant upfront investment and ongoing maintenance costs remain. Furthermore, the value of the car continues to depreciate even after it’s paid off, potentially resulting in a significant loss if you need to sell it. You are also responsible for all repairs and maintenance, which can be substantial, particularly as the car ages.

Maintenance and Repairs

Leasing and buying a car present distinct approaches to vehicle maintenance and repairs, significantly impacting your overall cost of ownership. Understanding these differences is crucial in determining which option best suits your needs and budget. While both involve expenses, the responsibility and the potential financial burden differ considerably.

Maintenance and repair costs are a significant factor in the total cost of car ownership, varying greatly depending on the vehicle’s make, model, age, and driving habits. These costs can be unpredictable, making it essential to factor them into your decision-making process when choosing between leasing and buying.

Maintenance Responsibilities

Typically, the leasing company is responsible for major repairs under the terms of the lease agreement, particularly those related to significant mechanical issues. However, routine maintenance like oil changes, tire rotations, and fluid top-offs usually fall to the lessee. For purchased vehicles, the owner bears full responsibility for all maintenance and repairs, from routine servicing to major mechanical overhauls. This responsibility extends to the vehicle’s entire lifespan.

Cost Implications of Maintenance and Repairs

The cost implications of maintenance and repairs differ significantly between leasing and buying. Leasing typically involves lower upfront costs associated with maintenance, as the lessee is only responsible for routine servicing. However, exceeding mileage limits or causing significant damage can result in substantial penalties. Buying a car, on the other hand, means bearing the full cost of all repairs and maintenance throughout the vehicle’s life. While this initially seems expensive, spreading these costs over a longer ownership period can potentially make it more manageable than frequent lease payments. Unexpected repairs on an older, owned vehicle can, however, represent a significant financial burden.

Typical Maintenance Costs Over Five Years

The following table provides a comparative overview of typical maintenance costs for a leased and owned vehicle over a five-year period. These figures are estimates and can vary significantly based on factors such as vehicle type, driving habits, and the frequency of required servicing. It is important to note that these estimates do not include the cost of major repairs, which are generally the responsibility of the leasing company in a lease agreement, but fall squarely on the owner in the case of a purchased vehicle.

| Year | Leased Vehicle (Estimated) | Owned Vehicle (Estimated) | Notes |

|---|---|---|---|

| 1 | $500 | $700 | Includes oil changes, tire rotations, and basic inspections. |

| 2 | $500 | $800 | May include brake pad replacement for owned vehicle. |

| 3 | $500 | $900 | Potential for more extensive servicing for owned vehicle. |

| 4 | $500 | $1000 | Depending on mileage and wear and tear. |

| 5 | $500 | $1200 | Potentially significant maintenance costs for owned vehicle. |

Mileage Limits and Restrictions

Leasing a car often involves a predetermined mileage allowance, a crucial factor to consider when comparing leasing to buying. Understanding these limits and the potential penalties for exceeding them is essential for making an informed decision. This section will clarify the typical mileage restrictions associated with car leases and the financial implications of exceeding those limits.

One significant difference between leasing and buying a car lies in the flexibility offered regarding driving distance. While car owners have unlimited mileage, lease agreements typically impose annual mileage limits. These limits vary depending on the lease term, vehicle type, and leasing company, but commonly range from 10,000 to 15,000 miles per year. Some luxury car leases might offer higher allowances, while others, particularly for shorter lease terms, may impose stricter limits.

Typical Mileage Limits in Car Leases

Lease agreements clearly state the allowed annual mileage. Exceeding this limit usually results in extra charges. For instance, a 36-month lease with a 36,000-mile limit (10,000 miles/year) will have penalties if you drive more than that total. Many leasing companies charge a per-mile overage fee, typically ranging from $0.10 to $0.25 per mile. Therefore, exceeding the limit by 5,000 miles could add several hundred dollars to the total lease cost. It’s vital to carefully review the lease contract and understand the implications of exceeding the mileage allowance.

Penalties for Exceeding Mileage Limits

The penalties for exceeding the mileage limit vary widely among leasing companies. As mentioned, a common penalty is a per-mile overage fee. However, some leasing companies may have a fixed overage fee regardless of the number of excess miles. Others might use a tiered system, where the cost per extra mile increases as the overage grows. For example, the first 1,000 excess miles might cost $0.15 per mile, while exceeding that threshold might raise the cost to $0.20 per mile. The exact cost is determined by the terms of your specific lease agreement. Before signing a lease, it’s critical to fully understand the overage penalty structure to accurately budget for potential excess mileage.

Driving Distance Flexibility: Leased vs. Owned Vehicles

The flexibility in driving distance significantly differs between leased and owned vehicles. Owned vehicles offer unlimited mileage; you can drive as much or as little as you desire without incurring additional costs. In contrast, leased vehicles have a fixed mileage allowance, restricting the total distance you can drive over the lease term. This limitation can be a significant factor for individuals with high annual mileage needs, such as long-distance commuters or those who frequently travel for work or leisure. If your driving habits suggest exceeding the typical mileage limits, purchasing a car may be the more financially sensible option.

Early Termination Fees

Breaking a lease or paying off a car loan early can involve significant financial implications, particularly concerning early termination fees. Understanding these fees is crucial for making an informed decision between leasing and buying a vehicle. These fees differ significantly between leasing and financing, and the circumstances surrounding early termination also play a vital role.

Early termination fees for leases are typically much higher than prepayment penalties for car loans. Lease agreements usually include a hefty fee, often calculated as a percentage of the remaining lease payments, to compensate the leasing company for their losses due to the early return of the vehicle. This is because the leasing company is responsible for reselling the vehicle at the end of the lease term and an early termination disrupts their planned revenue stream. In contrast, prepayment penalties for car loans are generally less severe and often decrease over time.

Lease Early Termination Fees

Lease agreements clearly outline early termination fees. These fees can vary widely depending on the leasing company, the length of the lease remaining, the vehicle’s condition, and the prevailing market value of the vehicle. For example, a lease with two years remaining might incur a fee equivalent to 10-20% of the remaining payments, potentially amounting to thousands of dollars. The leasing company might also charge fees for excess wear and tear beyond normal usage. It’s crucial to carefully review the lease contract to understand the specific terms and conditions surrounding early termination.

Loan Prepayment Penalties

While less common than lease termination fees, some car loans may include prepayment penalties. These penalties are designed to compensate the lender for lost interest income. However, many lenders are waiving prepayment penalties, especially in the current competitive market. The amount of the penalty, if any, is typically detailed in the loan agreement. It’s generally smaller than a lease termination fee and often decreases over the loan’s term. For instance, a prepayment penalty might be a percentage of the remaining loan balance, perhaps diminishing from 5% in the first year to 0% after three years.

Scenarios Requiring Early Termination

Several scenarios might necessitate early vehicle termination. Job relocation, unexpected financial hardship, or a significant change in personal circumstances, such as a family expansion requiring a larger vehicle, could trigger the need to end a lease or loan prematurely. In such cases, the financial consequences must be carefully weighed against the benefits of early termination. For example, relocating across the country might make commuting impractical with the current vehicle, offsetting the cost of the early termination fee. Conversely, facing significant financial difficulties could make continuing lease or loan payments unsustainable, making early termination a necessary, albeit costly, option. Each situation demands a thorough assessment of the financial implications and available alternatives.

Insurance Costs

Insurance premiums are a significant ongoing expense for both car owners and lessees, and understanding the differences can greatly impact your overall cost analysis. The type of coverage needed, the vehicle itself, and the driver’s profile all play a role in determining the final cost. Leasing and buying often present different insurance scenarios.

Insurance costs for leased vehicles often differ from those for owned vehicles due to several key factors. Lease agreements frequently require higher levels of coverage, such as collision and comprehensive insurance, to protect the leasing company’s financial interest in the vehicle. This can lead to higher premiums compared to the insurance on a car you own outright. Conversely, if you own your vehicle, you have more flexibility in choosing your coverage level and deductibles, potentially leading to lower premiums if you’re willing to accept a higher risk.

Factors Influencing Insurance Premiums

Several factors influence insurance premiums for both leased and owned vehicles. These factors interact to determine the final cost. A comprehensive understanding of these influences is crucial for accurate budgeting.

The vehicle’s make, model, and year significantly impact insurance costs. Generally, newer, more expensive vehicles, or those with advanced safety features, command higher premiums due to higher repair costs and a greater potential for theft. Conversely, older, less expensive cars typically have lower insurance premiums.

Driver profiles also significantly influence insurance rates. Factors such as age, driving history (including accidents and violations), credit score, and location all contribute to the premium calculation. Younger drivers, those with poor driving records, or those living in high-risk areas typically face higher premiums.

Examples of Insurance Cost Variations

Let’s consider two examples to illustrate the differences in insurance costs between leasing and buying a car.

Example 1: A young driver (22 years old) with a clean driving record leases a new luxury SUV. The lease agreement mandates full coverage insurance. Their insurance premium might be significantly higher due to their age and the vehicle’s value. If they owned the same SUV, they might opt for a higher deductible to lower their premium.

Example 2: An older driver (55 years old) with a long, clean driving record buys a used, economical sedan. Their insurance premium will likely be lower due to their age, driving history, and the vehicle’s value. If they leased a similar vehicle, their premium would still be relatively low, but the mandated coverage might slightly increase the overall cost compared to owning. In this scenario, the difference between leasing and buying insurance costs would be less pronounced than in Example 1.

Resale Value and Trade-ins

Understanding resale value is crucial when deciding between leasing and buying a car. The depreciation of a vehicle significantly impacts the financial outcome of both options, influencing your potential savings or losses. This section will explore how resale value and trade-in processes differ between leased and owned vehicles.

Resale value refers to the price a used vehicle can fetch on the open market. Cars depreciate most rapidly in their first few years, meaning their value drops considerably shortly after purchase. This depreciation affects both buyers and lessees, but in different ways. For buyers, the resale value is a key factor to consider when selling or trading in their vehicle. For lessees, the residual value (the projected value at the end of the lease term) is predetermined by the leasing company and factored into the monthly payments.

Resale Value Implications for Buying and Leasing

When you buy a car, you bear the brunt of depreciation. The difference between your purchase price and the eventual resale value represents your loss due to depreciation. For example, if you buy a car for $30,000 and sell it three years later for $18,000, you’ve experienced a $12,000 depreciation. Conversely, with leasing, the leasing company absorbs a significant portion of the depreciation. Your monthly payments reflect the predicted depreciation, and you are not responsible for the full drop in value once the lease is over. However, you will not benefit from any appreciation in value.

Trading in a Leased versus an Owned Vehicle

Trading in an owned vehicle is straightforward. You can take it to a dealership, and its value will be assessed based on its condition, mileage, and market demand. The assessed value will be used as a credit towards your next purchase or as part of a cash offer. Trading in a leased vehicle is more complex. You may be subject to early termination fees if you return the vehicle before the lease expires. The condition of the vehicle at lease-end is carefully inspected for damage, exceeding mileage limits, and wear and tear. Any excess charges are deducted from your security deposit or billed separately. Furthermore, the lease end value is often lower than the market value for the same vehicle if the leasing company accurately predicted the depreciation. Therefore, while you avoid depreciation during the lease, you are unlikely to profit from it at the end.

Financial Benefits and Drawbacks

Buying a car offers potential long-term financial benefits if you plan to keep it for many years and its resale value remains relatively high. However, the initial cost is higher, and you’re responsible for all maintenance and depreciation. Leasing offers lower upfront costs and potentially lower monthly payments, making it attractive to those who prefer predictable budgeting and don’t mind changing cars every few years. However, you have no equity in the vehicle at the end of the lease term, and you may face penalties for exceeding mileage limits or causing damage. The overall financial outcome depends greatly on individual circumstances, driving habits, and vehicle choices.

Long-Term Financial Implications

Choosing between leasing and buying a car has significant long-term financial consequences that extend far beyond the initial purchase or lease agreement. Understanding these implications is crucial for making a financially sound decision aligned with your individual circumstances and financial goals. This section will explore the long-term financial benefits and drawbacks of each option, focusing on how they impact your overall financial health.

Both leasing and buying a car involve distinct financial pathways with different advantages and disadvantages over time. While leasing might seem cheaper initially due to lower monthly payments, buying often proves more financially advantageous in the long run. The key lies in understanding how each option affects your net worth, debt levels, and overall financial flexibility.

Long-Term Debt Accumulation

A significant difference between leasing and buying lies in debt accumulation. When you lease, you are essentially renting the car, and you do not build equity. Your monthly payments contribute to nothing you can eventually own. Buying, on the other hand, allows you to build equity in the vehicle as you pay down the loan. This equity represents an asset that increases in value as you pay off the loan.

- Leasing: Results in no asset ownership at the end of the lease term. You will have made consistent payments, but you will have nothing to show for it except the use of the vehicle during the lease period.

- Buying: Allows you to build equity, meaning the car becomes an asset on your balance sheet. Once the loan is paid off, the car is entirely yours, representing a significant increase in your net worth.

Impact on Credit Score

Both leasing and buying can impact your credit score, but in different ways. Consistent on-time payments on a car loan or lease positively influence your credit score. However, managing the financial aspects of each option differently affects your credit score.

- Leasing: Requires a credit check and establishing a positive payment history. However, leasing doesn’t significantly build credit history in the same way as a loan secured by an asset.

- Buying: Successfully paying off a car loan demonstrates responsible credit management and positively impacts your credit score over a longer period, potentially leading to better interest rates on future loans.

Future Vehicle Costs

The long-term cost of transportation significantly differs between leasing and buying, especially considering future vehicle needs. The decision impacts your financial resources available for future vehicle purchases.

- Leasing: Requires a new lease agreement and associated fees every few years, potentially leading to a cycle of recurring costs and potentially higher interest rates if your financial situation has changed.

- Buying: Offers more flexibility. After paying off the loan, you can drive the car until it’s no longer reliable, potentially saving money on vehicle replacement costs for a considerable time.

Overall Financial Health

The long-term impact on your overall financial health depends heavily on your financial goals and risk tolerance. Consider your financial situation, savings goals, and risk tolerance when choosing between leasing and buying a car.

- Leasing: Can free up short-term cash flow, but it does not contribute to building long-term assets. It may be suitable for those prioritizing short-term affordability over long-term asset building.

- Buying: Requires a larger initial investment but contributes to asset building and long-term wealth accumulation. It is often a better option for those prioritizing long-term financial stability and wealth building.

Flexibility and Lifestyle Considerations

Choosing between leasing and buying a car significantly impacts your lifestyle and financial flexibility. The best option depends heavily on your individual circumstances, driving habits, and long-term plans. Understanding these factors is crucial for making an informed decision.

Leasing and buying cater to different lifestyles and needs. Leasing offers the advantage of driving a newer vehicle more frequently, with lower monthly payments, and less responsibility for maintenance and repairs during the lease term. Buying, conversely, provides long-term ownership, equity building, and greater freedom in terms of mileage and modifications.

Leasing Preferences

Leasing is often a preferable option for individuals who prioritize driving a new car regularly, desire lower monthly payments, and prefer not to deal with the complexities of vehicle maintenance and repairs beyond routine service. For example, a young professional who values a stylish, reliable car but doesn’t want to be burdened with high monthly payments or long-term vehicle ownership might find leasing advantageous. Similarly, someone who frequently changes vehicles to stay current with the latest models and technology might prefer the flexibility leasing offers.

Buying Preferences

Buying is a better choice for individuals who prefer long-term vehicle ownership, intend to keep the car for several years, and wish to build equity. For instance, a family that needs a reliable vehicle for transporting children and anticipates long-term use would benefit from buying. Individuals who modify their vehicles or plan to use them for extended periods, such as for off-roading or towing, might also find buying more suitable. The long-term cost savings associated with owning a vehicle outright can also make purchasing a better financial decision in the long run.

Vehicle Upgrade Flexibility

Leasing offers more frequent opportunities for vehicle upgrades. At the end of a lease term, you can simply return the vehicle and lease a newer model. Buying, on the other hand, requires selling or trading in your current vehicle before upgrading, a process that can be more time-consuming and less financially advantageous. This difference in flexibility directly impacts the type of driver who might prefer one option over the other. For instance, a driver who prioritizes always having the latest vehicle technology and features would likely prefer leasing. A driver who is satisfied with their current vehicle and is focused on cost-effectiveness would likely prefer buying.

Choosing the Right Option Based on Individual Needs

Choosing between leasing and buying a car is a significant financial decision that depends heavily on individual circumstances. There’s no one-size-fits-all answer; the best option hinges on your financial situation, driving habits, and long-term goals. Carefully considering the factors outlined below will help you make an informed choice that aligns with your needs.

Factors Influencing the Decision

This table summarizes key factors to consider when deciding between leasing and buying a vehicle. Weighing these aspects against your personal circumstances will illuminate the most suitable option for you.

| Factor | Leasing | Buying |

|---|---|---|

| Upfront Costs | Lower (typically smaller down payment) | Higher (larger down payment, potentially loan origination fees) |

| Monthly Payments | Generally lower | Generally higher |

| Vehicle Ownership | No ownership at lease end | Full ownership after loan repayment |

| Mileage Restrictions | Strict mileage limits, penalties for exceeding | No mileage restrictions |

| Maintenance & Repairs | Responsibility often varies by lease agreement | Buyer is fully responsible |

| Depreciation | Responsibility of the leasing company | Buyer absorbs depreciation |

| Flexibility | Easier to switch vehicles every few years | Commitment to one vehicle for longer term |

| Long-Term Costs | Potentially higher overall cost over multiple leases | Potentially lower overall cost if kept for many years |

Individual Financial Situations and Driving Habits

Your financial situation significantly impacts the optimal choice. Individuals with limited upfront capital might find leasing more accessible due to lower down payments. However, those with strong financial stability and a longer-term perspective may prefer buying, benefiting from eventual ownership and potentially lower overall costs. Driving habits also play a crucial role. High-mileage drivers may find leasing restrictive due to mileage limits and associated penalties. Conversely, low-mileage drivers might find leasing a cost-effective option. For example, a young professional with a limited budget and frequent job changes might find leasing more suitable than a family with stable finances and a preference for long-term vehicle ownership.

Weighing the Pros and Cons

Making an informed decision requires a careful evaluation of the advantages and disadvantages of each option. For instance, leasing offers lower monthly payments and the opportunity to drive a new car frequently. However, it leads to higher overall costs over time and lacks the equity building associated with ownership. Buying, on the other hand, provides long-term ownership and potential appreciation, but involves higher upfront costs and greater responsibility for maintenance and repairs. A thorough comparison of these factors based on your individual circumstances will guide you towards the most appropriate choice. For example, consider someone who values driving the latest models and has limited savings; leasing might be preferable. In contrast, someone prioritizing long-term cost savings and vehicle ownership would likely opt for buying.

Closure

Ultimately, the choice between leasing and buying a car is deeply personal. There’s no universally “right” answer; the optimal option depends entirely on your individual financial situation, driving habits, and long-term goals. By carefully weighing the initial costs, monthly payments, maintenance responsibilities, and long-term financial implications, you can confidently select the path that best aligns with your lifestyle and financial well-being. Remember to consider your driving needs, the potential for early termination, and the resale value of the vehicle. With a thorough understanding of these factors, you can confidently choose the car ownership experience that best suits your needs.