Top Car Insurance Companies in the US: Compare Rates and Coverage – navigating the world of car insurance can feel overwhelming. This guide simplifies the process, helping you understand the key factors to consider when choosing a policy that best suits your needs and budget. We’ll explore various coverage options, compare rates from leading insurers, and provide insights into deductibles, premiums, and customer service experiences. Ultimately, our goal is to empower you to make informed decisions and secure the best possible car insurance protection.

From liability and collision coverage to comprehensive protection and the impact of your driving record, we’ll dissect the complexities of car insurance. We’ll examine how factors like age, location, and credit score influence your premiums, and offer practical tips for finding discounts and savings opportunities. By the end, you’ll have a clear understanding of how to compare quotes, negotiate rates, and choose a policy that provides both comprehensive coverage and value for your money.

Key Factors in Choosing Car Insurance

Selecting the right car insurance policy can feel overwhelming, given the variety of options and coverage levels available. Consumers typically prioritize a balance between cost-effectiveness and comprehensive protection. Understanding the different aspects of car insurance is crucial for making an informed decision that aligns with individual needs and budgets. Factors such as driving history, vehicle type, location, and coverage requirements significantly influence the final premium.

Choosing the right car insurance involves careful consideration of several key factors. These factors go beyond simply finding the cheapest option; they involve understanding the level of protection needed and the services offered by different providers. A comprehensive understanding of coverage types, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage, is essential. Liability coverage protects you financially if you cause an accident resulting in injury or property damage to others. Collision coverage repairs or replaces your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects against damage from non-accident events like theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks sufficient insurance or is uninsured.

Comparison of Major Insurers

The following table compares three major car insurance providers across key features. Note that pricing varies significantly based on individual circumstances. These are illustrative examples and should not be considered definitive quotes.

| Feature | Geico | State Farm | Progressive |

|---|---|---|---|

| Coverage Options | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, and more | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, and more | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, and more |

| Price Range (Annual Premium Example) | $500 – $2000 (Illustrative) | $600 – $2500 (Illustrative) | $450 – $1800 (Illustrative) |

| Customer Service Ratings | Generally positive, with high customer satisfaction scores reported by J.D. Power | Generally positive, known for strong customer service reputation | Generally positive, known for online tools and accessibility |

Top 10 Car Insurance Companies

Choosing the right car insurance provider can significantly impact your finances and peace of mind. This ranking considers a combination of factors to provide a comprehensive overview of leading companies in the US car insurance market. It’s crucial to remember that individual experiences may vary, and the best company for you will depend on your specific needs and location.

This ranking utilizes a methodology combining publicly available data from industry rating agencies like J.D. Power and the NAIC (National Association of Insurance Commissioners), alongside analysis of customer reviews sourced from reputable platforms such as the Better Business Bureau and independent review sites. Weight is given to financial strength ratings, customer satisfaction scores, claims handling efficiency, and the breadth and depth of coverage options offered. This approach aims to present a balanced perspective, acknowledging both objective metrics and the subjective experiences of policyholders.

Top 10 Car Insurance Companies: A Ranked List

The following list presents the top 10 car insurance companies, ranked according to our methodology. Please note that rankings can fluctuate based on data updates and changes in the market.

- State Farm:

- Strengths: Extensive agent network, strong financial stability, wide range of coverage options, competitive pricing in many areas.

- Weaknesses: Customer service experiences can be inconsistent depending on the agent, some online tools may lag behind competitors.

- GEICO:

- Strengths: Highly competitive pricing, user-friendly online tools and mobile app, efficient claims process.

- Weaknesses: Limited agent network, customer service can be challenging to reach at times, may lack personalized service.

- Progressive:

- Strengths: Name Your Price® tool offers customized quotes, strong online presence, various discounts available.

- Weaknesses: Can be more expensive than some competitors for certain profiles, customer service reviews are mixed.

- Allstate:

- Strengths: Strong brand recognition, wide range of coverage options, significant agent network.

- Weaknesses: Pricing can be higher than some competitors, customer service experiences vary.

- USAA:

- Strengths: Excellent customer service, highly rated claims handling, competitive pricing for eligible members (military and families).

- Weaknesses: Membership eligibility restricted to military personnel and their families.

- Liberty Mutual:

- Strengths: Offers a variety of discounts, strong financial stability, good range of coverage options.

- Weaknesses: Pricing can be variable, customer service reviews are mixed.

- Farmers Insurance:

- Strengths: Extensive agent network, strong brand recognition, various coverage options.

- Weaknesses: Pricing can be higher than some competitors, online tools may not be as advanced as some competitors.

- Nationwide:

- Strengths: Strong financial stability, offers a variety of discounts, good range of coverage options.

- Weaknesses: Pricing can be higher than some competitors, customer service reviews are mixed.

- American Family Insurance:

- Strengths: Strong customer service ratings in certain regions, competitive pricing in some areas, good range of coverage options.

- Weaknesses: Availability may be limited in some areas, online tools may not be as comprehensive as some competitors.

- Travelers:

- Strengths: Strong financial stability, good range of coverage options, competitive pricing in some areas.

- Weaknesses: Customer service reviews are mixed, online tools could be improved.

Comparison of Rates Across Different Companies

Choosing the right car insurance policy often involves comparing rates from different providers. Understanding the factors that influence these rates is crucial to finding the best value for your needs. This section provides a comparison of average rates across five leading insurers, highlighting the key variables that contribute to price differences.

It’s important to remember that these are average rates and your individual premium will vary depending on several personal factors. The rates presented below are illustrative and should not be considered definitive quotes. Always contact the insurance companies directly for personalized quotes.

Average Rates for Similar Coverage Plans

The following table compares average annual premiums for a similar liability coverage plan (e.g., 100/300/50 bodily injury and $25,000 property damage) across five major US insurers. These figures are based on hypothetical profiles and may not reflect current market conditions. Actual rates will depend on your specific circumstances.

| Insurance Company | Average Annual Premium | State (Example) | Notes |

|---|---|---|---|

| Progressive | $1200 | California | Known for its online tools and discounts. |

| State Farm | $1350 | Texas | A large, established insurer with a wide range of options. |

| Geico | $1150 | Florida | Often advertised for its competitive rates. |

| Allstate | $1400 | Illinois | Offers various bundles and add-ons. |

| USAA | $1000 | Virginia | Primarily serves military members and their families. |

Factors Influencing Rate Variations

Several factors significantly impact car insurance rates. Understanding these allows consumers to better predict and potentially manage their insurance costs.

Age: Younger drivers, particularly those under 25, typically pay higher premiums due to statistically higher accident rates. Insurance companies assess risk based on age demographics. For example, a 20-year-old driver might pay significantly more than a 40-year-old driver with the same coverage.

Driving History: A clean driving record with no accidents or traffic violations results in lower premiums. Conversely, accidents, speeding tickets, or DUIs significantly increase rates. The severity and frequency of incidents directly affect the perceived risk and, consequently, the premium.

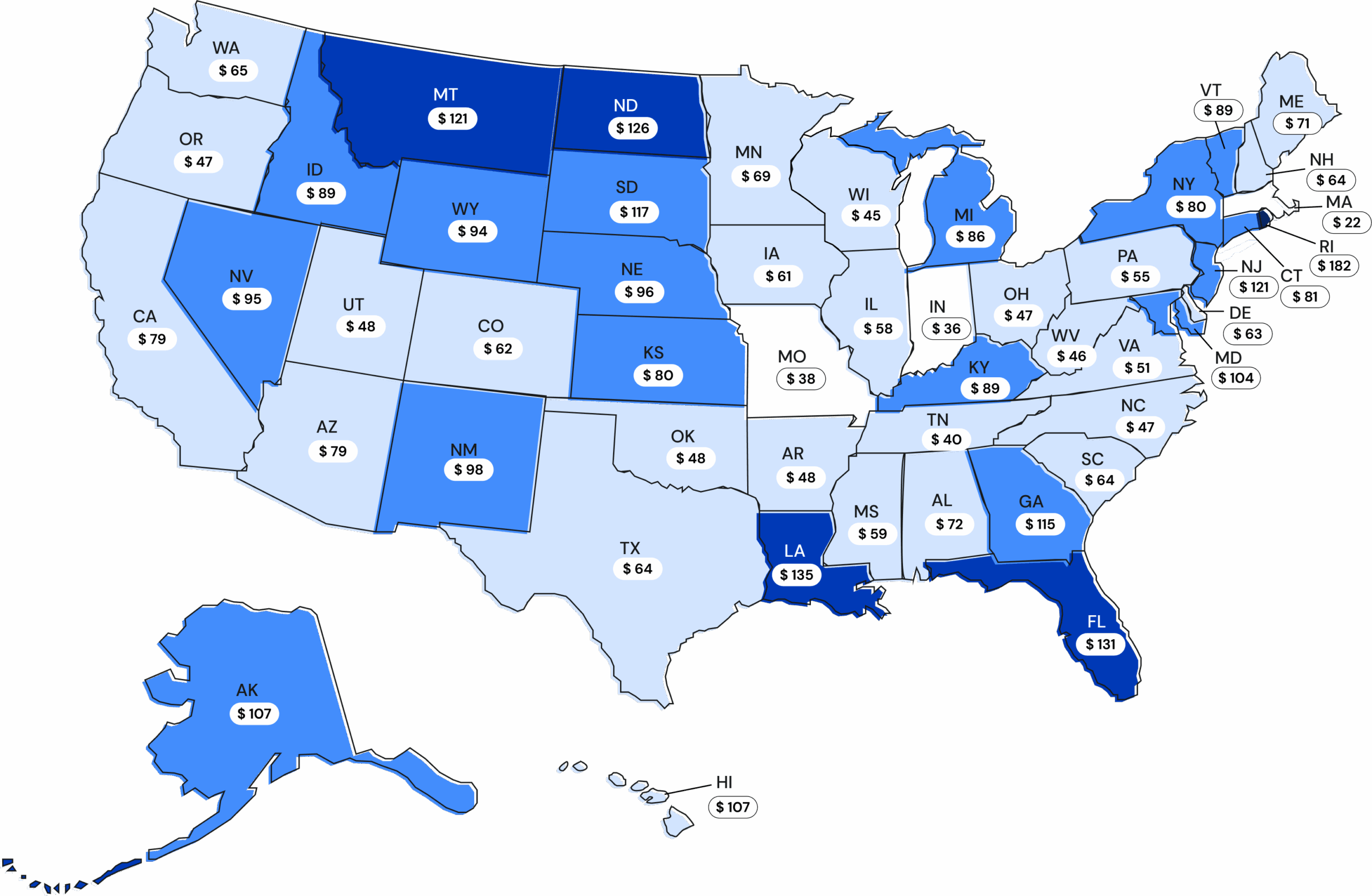

Location: Geographic location plays a crucial role in determining rates. Areas with higher crime rates, more traffic congestion, and a greater frequency of accidents generally command higher premiums. For instance, an urban driver in a high-crime area will likely pay more than a rural driver in a low-crime area, even with identical driving records and coverage.

In-Depth Coverage Analysis

Choosing the right car insurance coverage is crucial for protecting yourself financially in the event of an accident or other unforeseen circumstances. Understanding the different types of coverage and their benefits is essential to making an informed decision. This section will detail the common types of car insurance coverage, highlighting their advantages and limitations.

Liability Coverage

Liability coverage protects you financially if you cause an accident that results in injuries or damage to another person’s property. It typically covers bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers repairs or replacement costs for the other person’s vehicle or property. The limits of liability coverage are expressed as three numbers, such as 25/50/25, representing $25,000 for injuries to one person, $50,000 for total injuries in an accident, and $25,000 for property damage. For example, if you cause an accident resulting in $30,000 in injuries to one person, your $25,000 liability coverage would only cover that amount, leaving you responsible for the remaining $5,000.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This includes collisions with other vehicles, objects, or even rollovers. It’s important to note that collision coverage typically has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the remaining costs. For example, if you have a $500 deductible and your car repairs cost $2,000, you would pay $500, and your insurance would cover the remaining $1,500. Collision coverage is optional but highly recommended.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes damage from theft, vandalism, fire, hail, flood, and even animal strikes. Similar to collision coverage, comprehensive coverage usually has a deductible. Imagine a scenario where a tree falls on your car during a storm; comprehensive coverage would pay for the repairs, minus your deductible. This type of coverage is optional, but it provides peace of mind against unexpected events.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident caused by a driver who is uninsured or underinsured. This coverage can help pay for your medical bills, lost wages, and vehicle repairs if the at-fault driver’s insurance is insufficient to cover your losses. For example, if an uninsured driver causes an accident resulting in $10,000 in damages to your vehicle and $5,000 in medical bills, your uninsured/underinsured motorist coverage would help cover these expenses. This is particularly important in areas with high rates of uninsured drivers.

Medical Payments Coverage (Med-Pay)

Medical payments coverage (Med-Pay) helps pay for medical expenses for you and your passengers, regardless of fault, following an accident. This coverage can be particularly useful for covering smaller medical bills or expenses not covered by health insurance. Med-Pay is typically a smaller coverage amount compared to other coverages and can help reduce out-of-pocket expenses for medical treatment after an accident. For instance, if you are injured in an accident and incur $2,000 in medical bills, your Med-Pay coverage will help to pay for these expenses up to the limit of your policy.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage is similar to Med-Pay but often provides broader coverage. It can cover medical expenses, lost wages, and even death benefits for you and your passengers, regardless of fault. Some states require PIP coverage, and it’s often beneficial to have, as it provides financial protection for various accident-related expenses. PIP coverage is important because it provides first-party coverage, meaning you collect from your own insurer regardless of fault.

Understanding Deductibles and Premiums

Choosing the right car insurance policy involves understanding the interplay between premiums and deductibles. These two components are fundamentally linked, and your choices regarding one directly affect the other. This section will clarify their relationship and help you make informed decisions about your coverage.

Your premium is the amount you pay regularly (monthly, quarterly, or annually) to maintain your car insurance coverage. Your deductible, on the other hand, is the amount you pay out-of-pocket before your insurance coverage kicks in after an accident or covered incident. The relationship is inverse: a higher deductible generally leads to a lower premium, and vice versa.

Deductible and Premium Relationship

The core principle is that insurance companies assess risk. Someone willing to assume more risk (by choosing a higher deductible) is considered less costly to insure and therefore receives a lower premium. Conversely, someone opting for a lower deductible (meaning less out-of-pocket risk) is viewed as higher risk, resulting in a higher premium. This is because the insurance company anticipates paying out more frequently with lower deductibles.

Impact of Deductible Amount on Overall Cost

The impact of deductible choice on your overall cost depends on your risk tolerance and financial situation. Consider these scenarios:

| Deductible | Annual Premium | Potential Out-of-Pocket Cost (minor accident) | Potential Out-of-Pocket Cost (major accident) |

|---|---|---|---|

| $500 | $1200 | $500 | $500 + repair costs above $500 |

| $1000 | $1000 | $1000 | $1000 + repair costs above $1000 |

| $2000 | $800 | $2000 | $2000 + repair costs above $2000 |

In this hypothetical example, a higher deductible ($2000) results in a lower annual premium ($800), but significantly increases your out-of-pocket expense if you have an accident. A lower deductible ($500) means a higher premium ($1200), but reduces your potential out-of-pocket costs in case of an accident. The best choice depends on your individual circumstances and ability to absorb a large unexpected expense.

Financial Implications of Deductible Choices

Let’s illustrate with specific examples. Imagine two drivers, Sarah and John. Both have similar driving records and the same car.

Sarah chooses a $500 deductible and pays an annual premium of $1200. She’s involved in a minor fender bender with $800 in damages. Her out-of-pocket cost is $500 (her deductible).

John chooses a $2000 deductible and pays an annual premium of $800. He’s involved in the same accident. His out-of-pocket cost is $2000 (his deductible).

Over a five-year period, assuming no other accidents, Sarah pays $6000 in premiums and $500 in deductible, for a total of $6500. John pays $4000 in premiums and $2000 in deductible, for a total of $6000. In this scenario, John’s higher deductible saved him money over five years, despite the higher out-of-pocket cost for the single accident. However, a more serious accident could easily change this outcome. The best choice depends on individual risk assessment and financial stability.

Customer Service and Claims Process

Choosing a car insurance company involves more than just comparing rates; the quality of customer service and the efficiency of the claims process are crucial factors in determining overall satisfaction. A smooth and responsive claims process can significantly reduce stress during a difficult time, while readily available and helpful customer service can address concerns and prevent potential problems. This section compares the customer service experiences and claims processes of three major US car insurance companies: State Farm, Geico, and Progressive.

Customer Service Experiences

Many online reviews and independent surveys consistently rank customer satisfaction across these three companies. While individual experiences can vary, general trends emerge. State Farm often receives praise for its extensive agent network, providing personalized service and local support. Geico, known for its direct-to-consumer model, is frequently lauded for its quick and efficient online and phone support. Progressive, with its innovative tools like the Snapshot device, sometimes receives mixed reviews, with some praising its technological advancements and others expressing frustration with navigating its digital platforms.

Claims Process Comparison

The claims process differs significantly among these three companies. State Farm, with its large agent network, often emphasizes a more personalized approach. Policyholders typically work directly with a local agent throughout the claims process, potentially leading to faster resolution for simpler claims. Geico’s direct-to-consumer model generally results in a more streamlined, often digital, claims process. Policyholders frequently manage their claims online or through phone interactions, potentially leading to faster processing for straightforward claims. Progressive’s claims process incorporates technology, such as online portals and mobile apps, enabling policyholders to track their claims’ progress and submit documentation digitally. However, complex claims may require more interaction with representatives.

Comparative Table: Customer Service and Claims Process

| Company | Customer Service | Claims Process | Key Differences |

|---|---|---|---|

| State Farm | Extensive agent network, personalized service, local support. Generally high customer satisfaction ratings for personalized attention. | Personalized approach, often involves direct interaction with a local agent. Potentially faster resolution for simpler claims due to personalized attention. | Agent-based, personalized service. Strong emphasis on local relationships. |

| Geico | Quick and efficient online and phone support, known for its direct-to-consumer model. Generally high customer satisfaction ratings for efficiency. | Streamlined, often digital process. Online and phone-based interactions. Potentially faster processing for straightforward claims. | Direct-to-consumer, streamlined and digital approach. Emphasis on efficiency and speed. |

| Progressive | Mixed reviews; some praise technological advancements, while others express frustration with digital platforms. Customer satisfaction varies based on individual experience and claim complexity. | Incorporates technology, online portals, and mobile apps. Allows for digital claim tracking and documentation submission. Complex claims may require more interaction with representatives. | Technology-driven, with varying customer experiences depending on claim complexity and technological proficiency. |

Discounts and Savings Opportunities

Securing affordable car insurance involves more than just comparing rates; it also requires understanding and leveraging the numerous discounts available. Many companies offer a wide range of savings opportunities, allowing drivers to significantly reduce their premiums. By strategically utilizing these discounts, consumers can potentially save hundreds of dollars annually.

Many factors influence the cost of car insurance, but proactive steps can lead to substantial savings. Understanding the various discount programs offered by insurers is crucial in minimizing your annual expenditure.

Common Car Insurance Discounts

Car insurance companies offer a variety of discounts to reward safe driving habits and responsible financial practices. These discounts can significantly lower your premium, making insurance more accessible and affordable.

- Safe Driver Discounts: These are typically awarded to drivers with clean driving records, demonstrating a history of safe driving practices. The discount amount varies depending on the insurer and the driver’s specific record, with longer periods without accidents or violations resulting in larger discounts. For example, a driver with five years of accident-free driving might receive a 15% discount, while a driver with ten years might receive a 25% discount.

- Bundling Discounts: Insurers often offer discounts for bundling multiple insurance policies, such as combining car insurance with homeowners or renters insurance. This incentivizes customers to consolidate their insurance needs with a single provider, simplifying management and potentially leading to substantial savings. A typical bundling discount might range from 10% to 25% depending on the policies bundled and the insurance provider. For example, bundling home and auto insurance with the same company could save a homeowner $200 or more annually.

- Good Student Discounts: Many companies provide discounts to students who maintain a high grade point average (GPA). This encourages academic excellence and rewards responsible behavior. A typical discount might be 10% for a GPA above 3.0. The specific GPA requirement and discount percentage vary among insurance companies.

- Defensive Driving Course Discounts: Completing a state-approved defensive driving course can often result in a discount. These courses demonstrate a commitment to safe driving and can lead to a reduction in premiums. Discounts for completing such courses typically range from 5% to 15%, depending on the insurer and the state.

- Vehicle Safety Features Discount: Cars equipped with advanced safety features, such as anti-lock brakes (ABS), airbags, and electronic stability control (ESC), often qualify for discounts. These features demonstrate a commitment to safety and reduce the likelihood of accidents. Discounts can vary depending on the specific features and the insurer, potentially saving several percentage points on the premium.

- Payment Plan Discounts: Some insurers offer discounts for paying your premiums in full upfront, rather than opting for monthly installments. This eliminates the administrative costs associated with processing monthly payments. The discount for paying in full can range from 5% to 10% depending on the insurer and policy.

Maximizing Savings Through Discounts

To maximize savings, consumers should actively seek out and utilize all available discounts. This requires comparing offers from multiple insurance providers, providing accurate information during the application process, and maintaining a clean driving record.

Examples of Discount Impact on Costs

Consider a hypothetical scenario: A driver with a clean driving record (15% safe driver discount), who bundles their car and home insurance (10% bundling discount), and maintains a high GPA (10% good student discount) could potentially save up to 35% on their annual premium. If their annual premium without discounts was $1200, they could save $420 annually.

Factors Affecting Insurance Rates

Understanding the factors that influence your car insurance premiums is crucial for securing the best possible rate. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions to potentially lower your expenses. This section will explore the most significant factors and their impact on your premium.

Driving Record

A clean driving record is paramount in obtaining favorable car insurance rates. Insurance companies assess your risk based on your history of accidents and traffic violations. Multiple accidents or serious offenses, such as DUI, will significantly increase your premiums. Conversely, a spotless record will likely result in lower rates. For example, a driver with three accidents in the past three years will pay substantially more than a driver with no accidents. The severity of the accidents also matters; a minor fender bender will have less impact than a serious collision.

Credit Score

Surprisingly, your credit score plays a significant role in determining your car insurance rates in many states. Insurance companies often use credit-based insurance scores (CBIS) to assess risk, believing that individuals with poor credit are more likely to file claims. A higher credit score generally translates to lower premiums, while a lower score can lead to substantially higher rates. This is a controversial practice, but it remains a factor in many states’ rating systems.

Vehicle Type

The type of vehicle you drive directly affects your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive cars typically have lower insurance rates. Factors such as the vehicle’s safety rating and anti-theft features also influence the premium. A new, high-safety-rated car will usually be cheaper to insure than an older car with a poor safety record.

Location

Your location significantly impacts your car insurance rates. Insurance companies consider the crime rate, accident frequency, and the cost of repairs in your area. Living in a high-risk area with frequent accidents and thefts will result in higher premiums compared to a lower-risk area. Urban areas generally have higher rates than rural areas. For instance, someone living in a large city with high crime rates will likely pay more than someone living in a small, quiet town.

Illustrative Chart

Imagine a bar chart with four bars representing the four factors: Driving Record, Credit Score, Vehicle Type, and Location. The height of each bar represents the relative influence of that factor on the overall insurance premium. For example, the bar representing “Driving Record” might be the tallest, indicating its significant impact. The “Vehicle Type” bar might be the second tallest, followed by “Location” and then “Credit Score” (though the relative heights would vary depending on the specific situation and state regulations). This visual representation demonstrates that while all factors contribute, some have a more substantial influence than others on the final premium.

Choosing the Right Coverage for Your Needs

Selecting the appropriate car insurance coverage can feel overwhelming, but a systematic approach simplifies the process. Understanding your individual needs and budget is crucial to finding a policy that offers adequate protection without unnecessary expense. This involves carefully considering several factors and making informed decisions about the level of coverage you require.

The optimal car insurance policy balances your risk tolerance with your financial capacity. Higher coverage limits offer greater protection in the event of an accident, but naturally come with higher premiums. Conversely, lower limits reduce premiums but leave you more financially vulnerable in the case of a significant accident or claim. Finding the sweet spot requires careful consideration of your assets, liabilities, and driving history.

Determining Your Coverage Needs

A structured approach to selecting coverage begins with a thorough assessment of your individual circumstances. This includes considering the value of your vehicle, your driving habits, and your financial situation. A comprehensive evaluation will guide you toward the most suitable coverage options.

- Assess the value of your vehicle: The value of your car directly impacts the amount of collision and comprehensive coverage you need. For older vehicles, it might be more cost-effective to opt for lower coverage limits or even waive collision and comprehensive coverage altogether. For newer or more expensive vehicles, higher limits are advisable.

- Evaluate your driving record: A clean driving record often translates to lower premiums. However, individuals with a history of accidents or traffic violations may need to consider higher liability limits to mitigate potential financial risks associated with future accidents.

- Consider your financial situation: Your financial stability significantly influences your insurance choices. While higher coverage limits provide better protection, they also increase premiums. Balancing your need for protection with your budget is crucial. Those with limited financial resources might prioritize liability coverage to meet minimum legal requirements, while those with greater financial capacity can explore more comprehensive options.

Balancing Coverage Needs with Budget Constraints

Finding the right balance between comprehensive coverage and affordability requires a strategic approach. This involves exploring different coverage options and comparing quotes from multiple insurers to identify the most cost-effective solution that meets your minimum protection needs.

- Explore different coverage levels: Most insurers offer various coverage levels, allowing you to customize your policy to fit your budget. Compare quotes for different levels of liability, collision, and comprehensive coverage to find the best fit for your needs and financial capabilities.

- Increase your deductible: A higher deductible reduces your premium. Carefully consider your ability to pay a higher out-of-pocket expense in exchange for lower monthly payments. This requires a realistic assessment of your financial reserves.

- Bundle your insurance policies: Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant discounts. This can be a cost-effective strategy for saving money without compromising on essential coverage.

Practical Tips for Navigating the Insurance Selection Process

The process of choosing car insurance can be streamlined with careful planning and a proactive approach. This includes researching different insurers, comparing quotes, and understanding the terms of your policy before making a decision.

- Compare quotes from multiple insurers: Don’t settle for the first quote you receive. Shop around and compare prices and coverage options from at least three different insurers to ensure you’re getting the best deal.

- Read your policy carefully: Before signing up for a policy, thoroughly review the terms and conditions to ensure you understand the coverage details, exclusions, and limitations. Clarify any uncertainties with the insurer before committing.

- Ask questions: Don’t hesitate to contact insurers directly to ask questions about their policies, coverage options, and pricing. A clear understanding of your policy is essential to avoid future complications.

Reading and Understanding Insurance Policies

Your car insurance policy is a legally binding contract outlining your coverage and responsibilities. Understanding its contents is crucial to ensure you receive the appropriate protection and avoid unexpected costs in the event of an accident or claim. Taking the time to carefully review your policy will save you potential headaches down the line.

Key Sections of a Car Insurance Policy

A typical car insurance policy comprises several key sections. These sections provide details on the specifics of your coverage, limitations, and responsibilities. Familiarizing yourself with each section is essential for a complete understanding of your policy.

- Declarations Page: This page summarizes your policy’s key information, including your name, address, vehicle details, coverage types, policy number, and premium amount. It serves as a quick reference guide to your policy’s essential details.

- Coverages: This section details the specific types of coverage you have purchased, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each coverage type will have its own limits of liability, explaining the maximum amount the insurance company will pay for covered losses.

- Exclusions: This crucial section outlines what is *not* covered under your policy. Understanding these exclusions is vital to avoid disappointment if a claim is denied. Common exclusions might include damage caused by wear and tear, intentional acts, or driving under the influence.

- Conditions: This section outlines your responsibilities as a policyholder, such as notifying the insurance company promptly after an accident, cooperating with investigations, and maintaining accurate information on your policy application.

- Definitions: This section clarifies the meaning of key terms used throughout the policy, ensuring a consistent understanding of the terminology. Understanding these definitions is critical for interpreting the policy’s clauses accurately.

Tips for Understanding Complex Policy Language

Insurance policies often employ specialized legal language that can be challenging to decipher. However, several strategies can help you navigate this complex terminology and gain a clear understanding of your coverage.

- Read slowly and carefully: Avoid rushing through the document. Take your time to understand each section and its implications.

- Use a dictionary or online resources: If you encounter unfamiliar terms, look them up to ensure you understand their meaning within the context of the policy.

- Ask for clarification: Don’t hesitate to contact your insurance agent or company if you have any questions or need clarification on specific aspects of your policy.

- Summarize key points: After reviewing each section, take notes summarizing the key information to aid in your comprehension and retention.

- Compare policies: If possible, compare your policy to others to better understand industry standards and common practices.

Common Policy Exclusions and Limitations

Insurance policies often exclude certain types of losses or limit the amount of coverage provided. Being aware of these common exclusions and limitations is essential to avoid unexpected costs or denied claims.

- Damage caused by wear and tear: Normal wear and tear on your vehicle is typically not covered by insurance.

- Damage from driving under the influence: Insurance companies usually exclude coverage for accidents caused by driving while intoxicated.

- Damage from illegal activities: Claims arising from illegal activities are generally not covered.

- Losses exceeding policy limits: Your insurance coverage is limited to the specified amounts in your policy. If your losses exceed these limits, you will be responsible for the remaining costs.

- Certain types of damage: Some policies may exclude coverage for specific types of damage, such as damage from floods or earthquakes, unless you have purchased additional coverage.

Finding the Best Deal

Securing the most affordable car insurance without compromising coverage requires a strategic approach. This involves more than simply accepting the first quote you receive. By employing effective comparison techniques and understanding your negotiating power, you can significantly reduce your annual premiums.

Finding the best car insurance deal necessitates a proactive and informed approach. This involves leveraging various resources and strategies to compare rates and ultimately secure the most favorable policy for your needs and budget. Careful consideration of multiple factors, from coverage options to personal details, will significantly impact the final price.

Shopping Around and Comparing Quotes

Obtaining quotes from multiple insurers is crucial for finding the best deal. Different companies utilize varying algorithms and assess risk differently, leading to substantial variations in pricing. Avoid settling for the first quote; instead, dedicate time to gathering at least three to five quotes from a mix of large national companies and smaller regional insurers. Online comparison tools can streamline this process, allowing you to input your information once and receive multiple quotes simultaneously. However, remember to verify the information provided by these tools with the individual insurers themselves.

Negotiating with Insurance Companies

While many believe insurance rates are fixed, there’s often room for negotiation. Once you’ve received several quotes, you can leverage the lower offers to negotiate with insurers who initially provided higher quotes. Highlighting your willingness to switch providers and emphasizing your clean driving record and other positive factors can influence their willingness to lower their price. Be polite but firm in your negotiations, and remember to clearly articulate your expectations and the reasons why you believe a lower rate is justified.

Effective Strategies for Comparing Rates

Several strategies can enhance your ability to compare rates effectively. First, ensure you’re comparing apples to apples. Make sure all quotes reflect the same coverage levels, deductibles, and other relevant factors. Second, consider bundling your insurance policies. Many insurers offer discounts for bundling car insurance with home or renters insurance. Third, explore potential discounts. Good student discounts, safe driver discounts, and multi-car discounts are common, so be sure to inquire about any applicable discounts. Finally, review your coverage needs regularly. As your life circumstances change, so too might your insurance needs. Periodically reviewing your policy can help you identify areas where you can reduce costs without sacrificing necessary protection.

Summary

Choosing the right car insurance is a crucial financial decision. By carefully considering the factors discussed – coverage types, rate comparisons, customer service, and available discounts – you can confidently select a policy that aligns with your individual circumstances and budget. Remember to shop around, compare quotes from multiple insurers, and don’t hesitate to negotiate for better rates. With a little research and planning, you can secure the best possible car insurance protection while maximizing your savings. Drive safely and confidently, knowing you have the right coverage in place.